1800 child tax credit december 2021

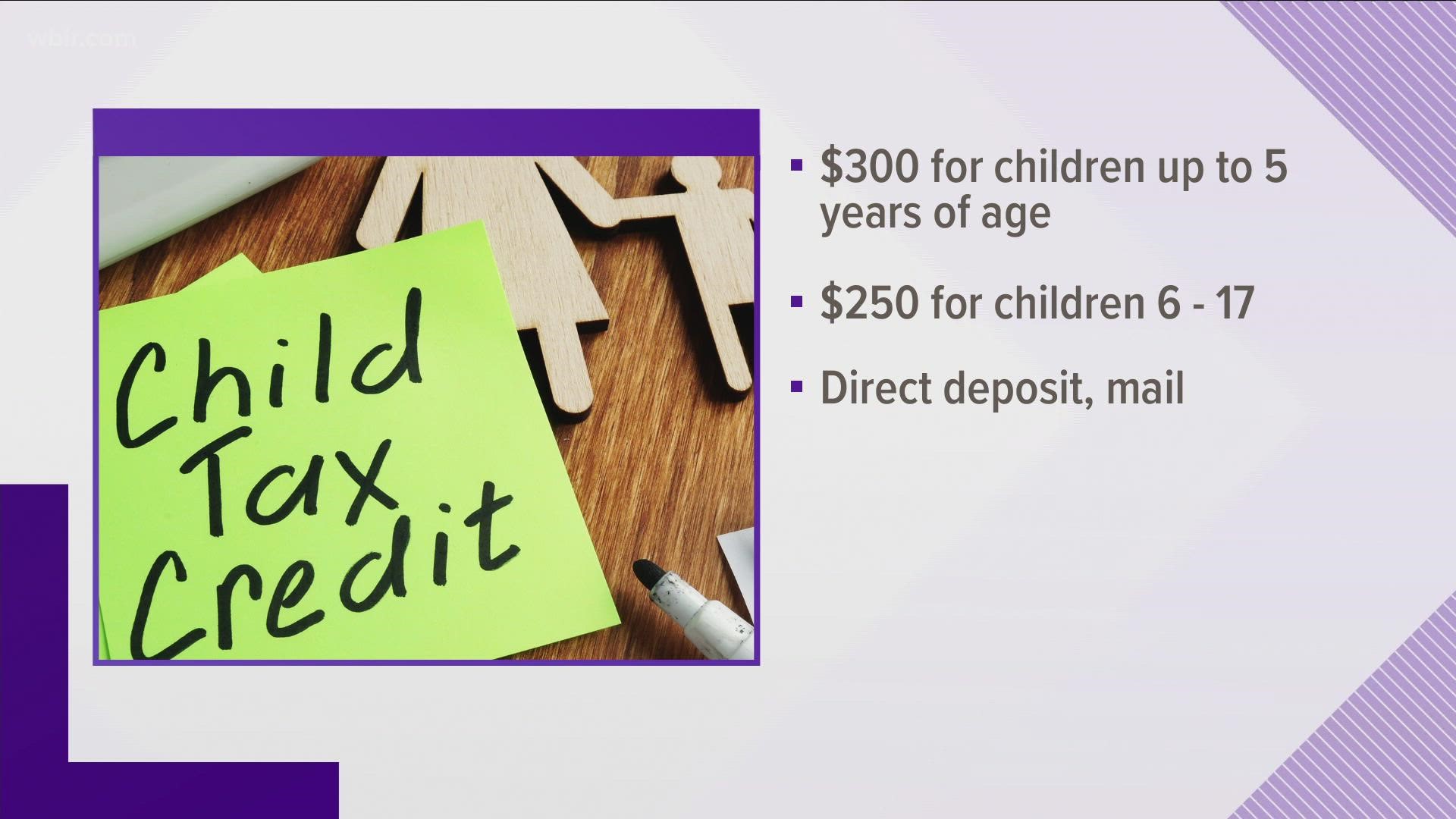

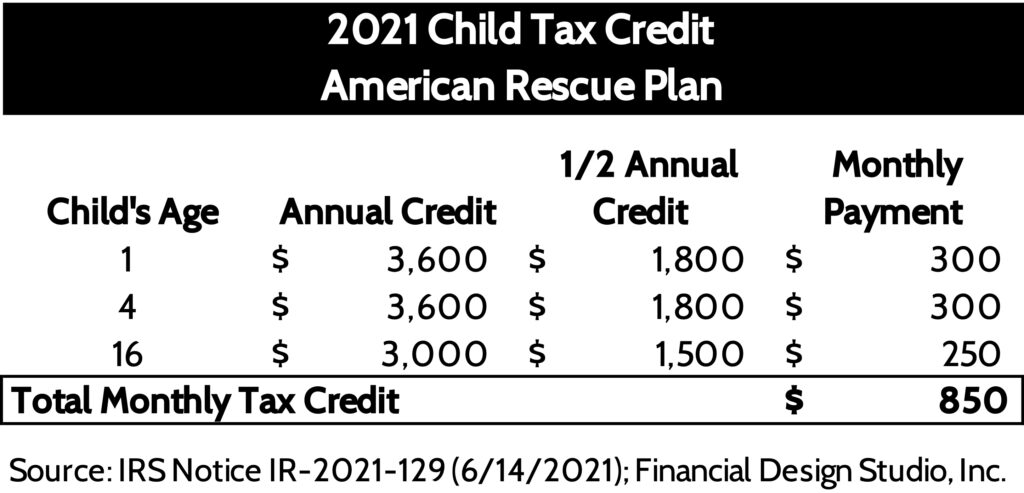

Those who signed up will receive half of their total child tax credit payment up to 1800 as a lump sum in December. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com

If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to.

. Advanced child tax credits are expected to end in Dec. Eligible families will receive up to 1800 in cash through December however the tax credit has a wrinkle that may prompt some families to bypass the federal program. 3600 for children ages 5 and under at the end of 2021.

Although the monthly advance payments ended in December the tax season 2022 distribute the remaining Child Tax Credit money to eligible parents along with their 2021 tax refunds. This means a payment of up to 1800 for each child under 6 and up to 1500. There is still money in the expanded child tax credit of the American Rescue Act of 2021.

While the monthly advance payments ended in December the tax season 2022 distribute the remaining Child Tax Credit money to eligible parents along with their 2021 tax refunds. Families with kids under age 6 can expect up to 1800 while families with kids. Typically families get up 300 per child - but some will get more this month.

Thats potentially 1800 for each child up to age 5 or 1500 for kids age 6-17 for those who signed up for the first time in early November. 2021 though you can still collect the remaining half of your credit either 1800 or 1500 when you file your 2021 tax. The 500 nonrefundable Credit for Other Dependents amount has not changed.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. If you and your family are eligible and received each payment between July and December of this year you can expect to receive up to 1800 for each child age 5 or younger or up to 1500 for. Some families that have found themselves struggling since the start of the pandemic will be happy to see up to 1800 tomorrow.

The credit is now 3600 annually for children under the age of six and 3000 for children aged 6 to 17. Families eligible for the child tax credit will get at least half of their total money. 3000 for children ages 6 through 17 at the end of 2021.

However the deadline to apply for the child tax credit payment passed on November. Families signing up now will normally receive half of their total Child Tax Credit on December 15. This includes up to 1800 per child under 6 or 1500 per child 6-17 or up to 3600 per child under.

Parents can expect more money to come from expanded child tax credit This year. To qualify for the full payments couples need to make less than 150000 and single parents who. 15 is the final payment for the.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. The remainder can be claimed when filing 2021 taxes in. If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and younger or up to 1500 for each child aged between six.

The 19 trillion relief bill. Six months of payments were advanced on a monthly basis through the. You may need to pay it back.

Are you getting the December child tax credit payment. Eligible families will receive up to 1800 in cash per child through December part of the American Rescue Plan that President Biden signed into law in March.

Tas Tax Tips Early Information About Advanced Child Tax Credit Payments Under The American Rescue Plan Act Taxpayer Advocate Service

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Brought To You By Providers

Irs Is About To Send December S Child Tax Credit Payment January S Depends On Congress Wsj

Schumer Hails New Child Tax Credit Plan Citing Benefits Over A Child S Lifetime Norwood News

Irs Is About To Send December S Child Tax Credit Payment January S Depends On Congress Wsj

Some Families Missing Out On Child Tax Credit

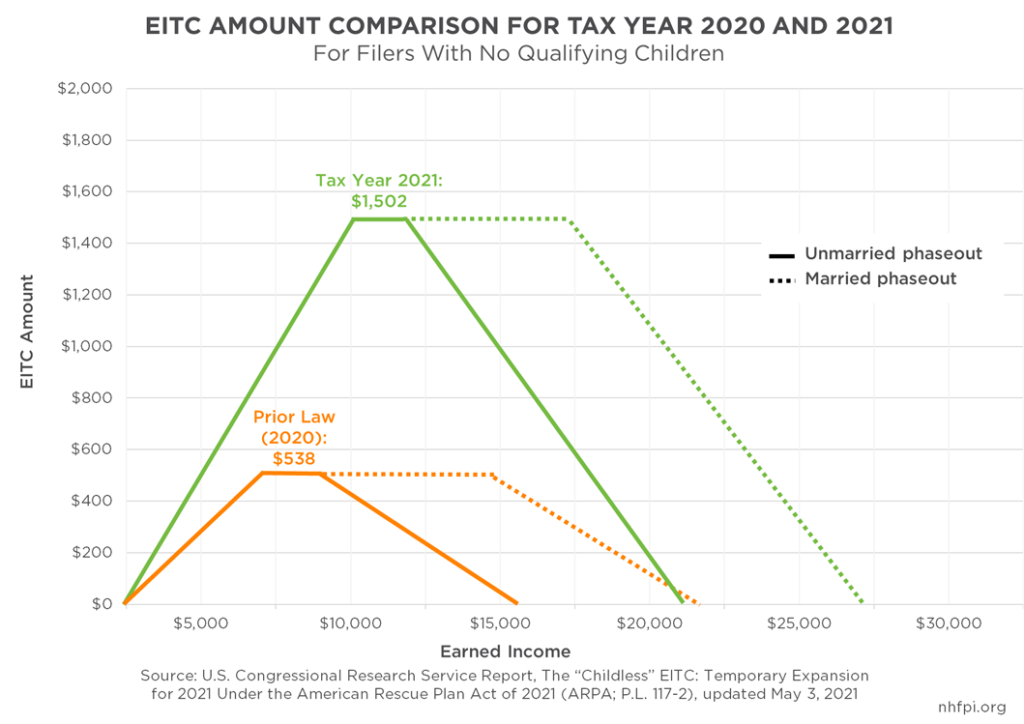

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

Child Tax Credit December 2021 How To Track Your Payment Marca

2021 Advanced Child Tax Credit What It Means For Your Family

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

2021childtaxcredit Explore Facebook

How Much Money Will Families Have Received From Child Tax Credit By December 2021 As Usa

Child Tax Credit Will Monthly Payments Continue In 2022 King5 Com

Stimulus Update Some Families Will Get 1 800 Child Tax Credit In December Al Com

Advance Child Tax Credit Payments Learn If You Need To Pay Money Back Cnet

Some Families Will Get 1 800 Per Child In Child Tax Credits In December Are You Eligible The Us Sun

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Frequently Asked Questions On The Child Tax Credit Children S Defense Fund